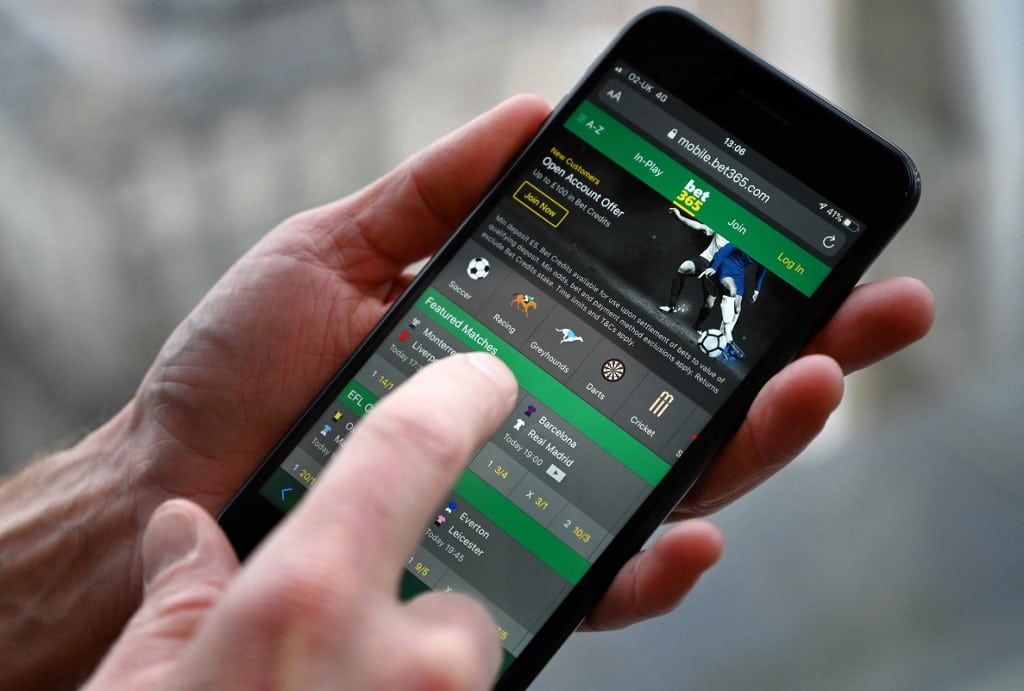

Rumors have been percolating throughout the gaming industry that the owners of Bet365 are considering selling the British gambling company for what would be billions of dollars.

Family Fortune

An industry insider has described the potential sale of Bet365 as being in the “beauty parade” stage, with the company teasing a possible sale while outside firms assess its value. Company executives have had preliminary discussions with Wall Street banks and US financiers, which have led to the rampant rumors.

The family business, led by Denise Coates, 57, has already transferred its Stoke City soccer club to Denise’s brother and partner, John Coates, to separate the two entities, ensuring the club will remain in the family in the event of a sale. It has also been reported that Bet365 has pulled out of China, which is another indicator that the company is being made as attractive as possible to potential suitors.

“It would be very difficult to have China exposure given the level of scrutiny that might be applied in the US, and why would you have a football club attached? That’s a family legacy,” said Paul Leyland, the director of the gambling consultancy Regulus Partners.

Denise and her brother John Coates launched the online version of Bet365 in 2000, taking it from its humble brick-and-mortar beginnings created by their father, Peter, to an online gaming powerhouse. But it was Denise, fresh out of Sheffield University with an econometrics degree, who has captained what has become a family dynasty.

Cheaper to Buy Than Create

Eilers & Krejcik Gaming (EKG) analysts have put an estimated value on the company at $12 billion, but purchasing a proven commodity is certainly easier and could prove less expensive in the long run than creating a new challenger in the fiercely competitive international gaming industry.

“There’s more money chasing gambling than there are gambling companies that are investable,” said EKG’s Leyland.

Bet365 is a European powerhouse but has had less success cracking the US gaming market, which is dominated by the duopoly of FanDuel and DraftKings. However, the company controls roughly 3% of the US market, which puts it in line with others like ESPN Bet.

However, Bet365 has made strides in expanding its US footprint to where it now operates in 13 US states and is expected to gain licenses in many more. It has been lauded for its customer service, breadth of markets, and technology component, making it an attractive acquisition target for greater future returns in the US market.

Future Outlook

“That is not an easy or cheap market to crack and potentially requires more funding to enable them to aggressively attack the opportunity,” said Alun Bowden, an EKG analyst. “Now feels like a very good time to explore exit opportunities, and the timing feels right with Denise turning 60 in two years’ time.”

The company showed a pretax profit of $838 million on revenues of $4.95 billion last year.

Bowden added, “For decades people have been telling me the one business they wish they could invest in was Bet365, and while there is a bit of an industry consensus that they are a fading star, they remain one of, if not the best, online sports betting business in the world, with huge headroom for growth in casino, the US, and many other markets. I don’t think they will have many problems.”